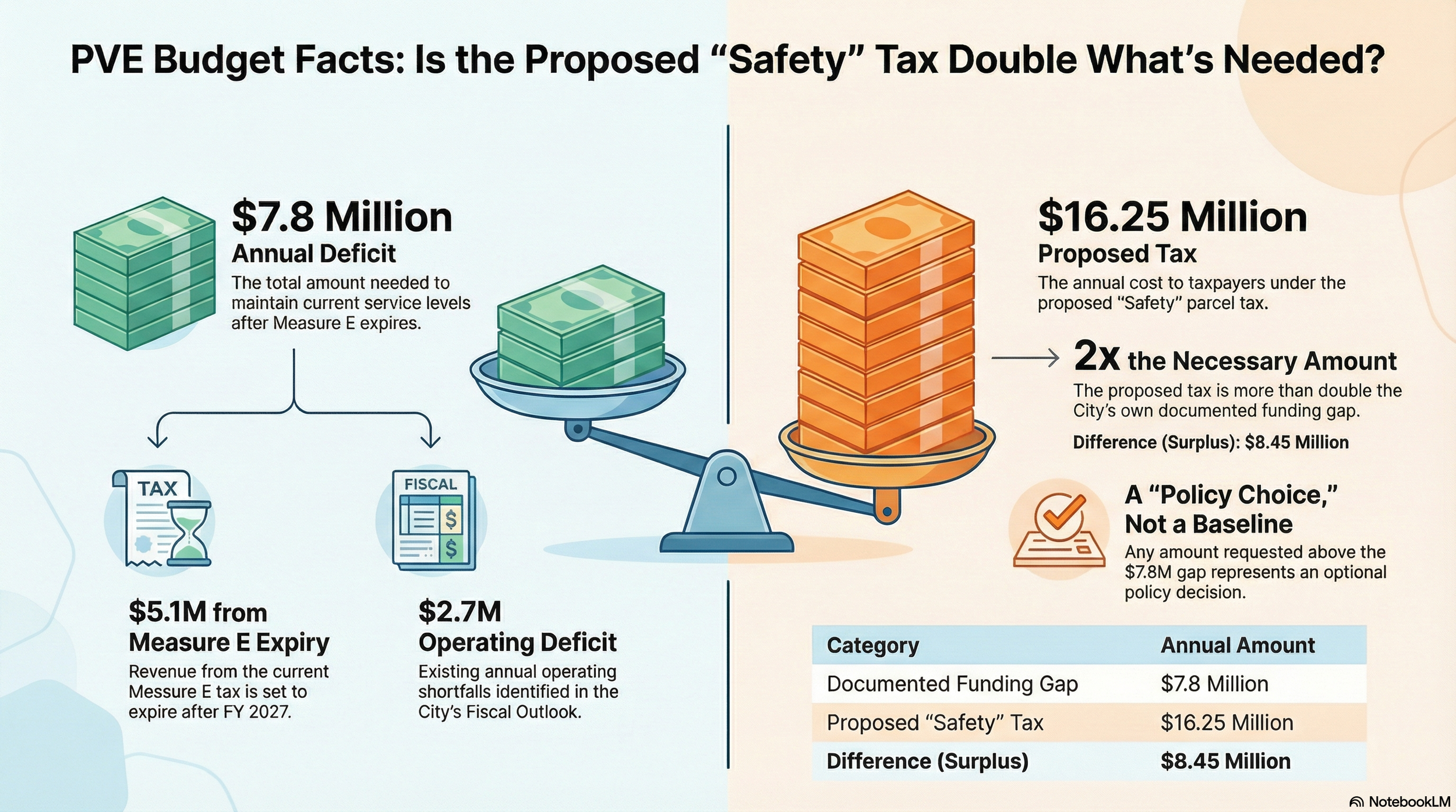

PVE Budget Facts – “Safety” Tax is Double PVE’s Documented Funding Gap

Chart above shows City of PVE’s projected revenues and expenses after Measure E expires (2028) with an annual deficit of $7.8 M

Executive Summary

The proposed parcel tax of $16.25 million per year would cost taxpayers more than double the amount needed.

City budget documents show a funding gap of $7.8 million per year to maintain current service levels after Measure E expires.

The chart below compares the City’s own projections that shows an annual $7.8 million funding gap to the proposed $16+ million “Safety” parcel tax.

The City’s Documented Funding Gap

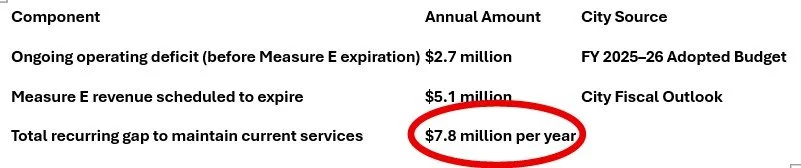

Based on the City of PVE FY 2025–26 Adopted Budget and Fiscal Outlook, the recurring $7.8 million funding gap consists of the following components:

What Happens After Measure E Expires in 2028

Measure E currently provides $5.1 million per year in revenue. City’s Fiscal Outlook (slide 10) states this revenue expires after FY 2027.

Absent replacement revenue before 2028, the City would face:

Existing operating deficits of approximately $2.7 million per year, plus

The loss of $5.1 million per year from Measure E

This results in a recurring funding gap of approximately $7.8 million annually.

The proposed $16.25 million “Safety” tax will cost taxpayers twice the amount shown as necessary according to the City’s own budget documents.

Why This Matters

Residents evaluating tax proposals should be able to see:

The size of the documented funding gap

How proposed taxes compare to that gap

Whether additional revenue beyond the gap is justified

Those questions should be answered by the City’s own financial documents.

Closing

City’s published budget documents show a gap of $7.8 million per year to maintain current services. The proposed parcel tax would cost taxpayers more than double that amount.

If additional revenue is required beyond the documented gap, a reconciled projection explaining the difference should be published so residents can evaluate it.

Scope and methodology

This summarizes only the City of Palos Verdes Estates’ own published documents (FY 2025–26 Adopted Budget and Fiscal Outlook) to show the actual budget gap to derive the tax amount. No other source, outside of the City, is used.

FAQs - Frequently Asked Questions

-

2028, until then and throughout 2027, Measure E funds are available.

-

All numbers shown here come ONLY and directly from City of Palos Verdes Estates financial documents, including the adopted budget and City fiscal outlook presentations.

-

No.

The figures shown use the City’s baseline projections, which include only existing, voter-approved revenue sources. They do not assume approval of any future parcel tax or tax increase. -

Yes — but only while it is legally in effect which includes 2027.

After FY 2026–27, Measure E revenue is removed unless voters approve another tax.

-

Some City planning documents include illustrative scenarios that assume a another future tax is approved at a higher level.

This page focuses only on the baseline projections so readers can clearly see the funding gap without assuming unapproved new taxes. -

No.

This page does not advocate for or against any tax proposal. Its purpose is to present City-published baseline numbers so residents can evaluate tax proposals using facts. -

Not necessarily.

The projections show the size of the funding gap under baseline assumptions.

How (or whether) that gap should be addressed — through taxes, spending changes, or both — is a separate decision for residents / voters. -

The proposed tax amount reflects a policy choice, not a baseline projection.

Baseline projections show the gap based on existing services and revenues.

Any tax proposal may choose to raise more than the baseline gap for a variety of reasons, but that distinction is important and should be communicated to voters and addressed in the text of the tax. -

-

City documents are often lengthy and include multiple scenarios.

This location consolidates the baseline figures only, in one place, so residents can clearly understand the projected funding gap to asking meaningful questions and consider their vote.

If you see different numbers cited elsewhere, check whether they assume future tax increases. Baseline projections and advocacy scenarios often answer different questions.